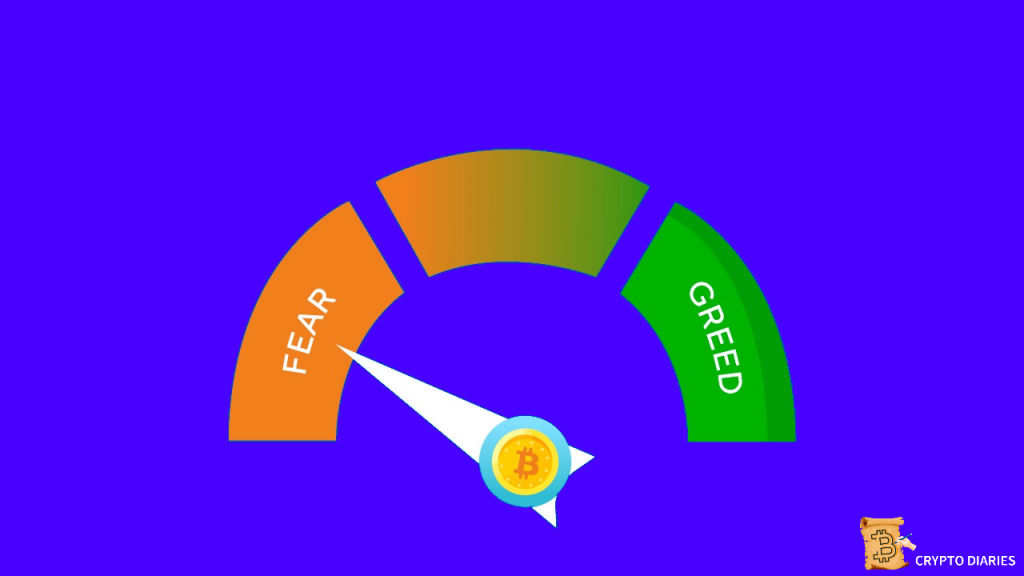

The crypto market is a market that is well known to have significant periods of uncertainty. The market volatility level is very high, pushing emotions such as fear and greed to their limits. Usually, when the market is fearful, cryptocurrencies tend to have a bearish market sentiment. The alternative is also genuine. During a greed-based market, digital assets tend to have a bullish market sentiment.

What happens during a Bullish and Bearish Market Sentiment?

Bullish Crypto Sentiment

During a bullish sentiment, retail and institutional investors tend to have high hopes in the market. Billions of dollars are thrown into digital assets pushing prices higher and higher. The relative cost of digital assets generally pumps during this time.

These are usually the good times when everyone makes money by buying and selling at different prices. Very few people sell at these times; everyone hopes the market will break records.

At these times, good projects surge in prices pumping to insane triple+ percentage digits due to a lot of hype. Bitcoin’s relative index is greed and usually the first digital asset most new investors buy after ‘digital gold’ breaks headlines for being more expensive than ever.

Bearish Crypto Sentiment

During a bearish market sentiment, the opposite happens. A significant sell-off is observed as whales cash out on their vast positions. Crypto prices tank heavily, inflicting a lot of fear on the public. Very few people and financial institutions buy anything at these times. Some divert to other markets, such as the stock market, where things appear to be better than the crypto market.

The current market sentiment is extreme fear, just under 20 points from the possible 100 points. Since the beginning of the bear market, the crypto trading volumes have plummeted significantly, wiping out over 3 trillion dollars worth of asset valuation. Bitcoin dropped from its highest-ever recorded price of $69,000 to around $17,000.

How to use the Crypto Fear and Greed Index

An index was developed to gauge investors’ fear and greed in the cryptocurrency market. It is used to examine how investors behave in the cryptocurrency market.

The index is divided into the following four categories:

0-24: Extreme fear (orange)

25-49: Fear (amber/yellow)

50-74: Greed (light green)

75-100: Extreme greed (green)

Investors receive news promptly and can act immediately without having to wait for the market to open during business hours when significant market events, whether positive or negative, occur. An index was developed to gauge investors’ fear and greed in the cryptocurrency market. It is used to examine how investors behave in the cryptocurrency market.

Investors receive news promptly and can act immediately without having to wait for the market to open during business hours when significant market events, whether positive or negative, occur. Think of it this way; the news is delivered simultaneously to investors worldwide. Unlike other investment markets, this is more likely to result in ‘FOMO buying’ or ‘panic selling’ behavior.

The Crypto Fear and Greed Index is utilized to evaluate investor behavior to help with judgment when there is a demand influx to purchase or sell within this 24/7 market.

As a result, one is free to act without being constrained by market sentiment, which may help investors better stick to their investment plans.

The Crypto Fear and Greed Index has a scale from 0 to 100, with 0 denoting the level of extreme investor fear that could lead to significant selling pressure. The opposite of a value of 100 is that investors are becoming overly greedy. FOMO could bring on some buying momentum.

Factors Considered when Calculating the Fear and Greed Index

The index currently only contains Bitcoin. Due to its volatility, Bitcoin is the cryptocurrency that will have the most significant impact on the market. Other indexing criteria have been developed as a result of this fact, including:

Volatility-25%

The figure is determined by comparing the price of Bitcoin’s fluctuation and maximum downturn to the 30-day and 90-day average volatility. Liquidity increases are a sign of market exuberance.

Market Volume/Momentum-25%

This figure is based on trading volume and momentum, similar to volatility, and calculated by comparing the 30-day and 90-day moving averages when the buy side is active, and the market is rising. This translates to market greed on the part of investors.

Social Media-15%

They use the hash symbol (#) to analyze each cryptocurrency. The number of responses and response rate is used in the calculation.15% of the population is polled about their opinions of a temporarily unavailable website.

Market Dominance-10%

The market capitalization ratios of Bitcoin and alternative cryptocurrencies, where Bitcoin is viewed as a haven when market jitters occur, and alternative cryptocurrencies are only used for speculation. As a result, examining the market capitalization share can reveal information about investor sentiment. However, this is, of course, debatable because an increase in the market capitalization of Altcoins may reflect genuine investor interest.

Trends-10%

They are utilizing Google Trends to look at Bitcoin-related keywords. If the number of searches for words related to Bitcoin rises, investors may become more interested in the cryptocurrency market.

Benefits of the Fear and Greed Index

The cryptocurrency fear and greed index chart is a valuable tool for active investors and a trustworthy technical indicator of market trends.

Thanks to the fear and greed index, investors in cryptocurrencies don’t have to invest aimlessly or invest hours in research.

Using the index, investors can comprehend the mood of the market. When the index points are at either extreme, they can exercise caution. Investors can decide whether to buy or sell cryptocurrencies based on the index’s score.

Risk-taking investors can use the index to invest against market trends. This tactic typically works in a volatile market by seizing trends at a time when other investors are reluctant to make bets.

Insights From the crypto Fear and Greed Index

Image courtesy of cointree.com

The Crypto Fear and Greed Index historical chart, provided by BTC Tools, demonstrates how the perception of bitcoin has evolved over a more extended period, specifically from June 2019 to October 2020.

As you can see, the index rarely dips into extreme fear for longer than a month and typically stays in the greed range. It also demonstrates how major crypto-related events have been correlated with attitudes toward bitcoin over the past two years.

We can see that the index fell to its lowest point in March 2020 due to the spread of coronavirus fear and a decline in the value of cryptocurrencies like Ethereum, Litcoin, Terra, and Ripple, as well as the financial markets.

It should be noted that it peaked in February 2021 after a run from AU$10,000 to AU$50,000. Additionally, the ‘DeFi summer’ period’s enormous profit opportunities fell during that time. As you can see, it remained there for more than a month before the abrupt drop that followed the public disclosure of China’s mining ban.

On a larger scale, this graph highlights two crucial aspects of the Crypto Fear and Greed Index. First, it is subject to sudden change due to breaking news or falling prices. Second, it can persist for a long time in greed and extreme greed levels.

Overall, it demonstrates that the sentiment surrounding bitcoin has been overwhelmingly positive for the past two years.

Is the Index a Long- or Short-Term Indicator?

The historical chart shows that the Crypto Fear and Greed Indicator does not closely correlate to longer-term bull runs. Instead, it responds to breaking news and momentary fluctuations in the cryptocurrency market. These factors make it more popular among traders as a short-term indicator than a long-term indicator. As one might anticipate, traders particularly like it.

The overall market can act irrationally in the short term when we look at the Crypto Fear and Greed Index. How can I control my emotions as an individual investor and prevent greed or fear from influencing my investment choices?

Many traders employ the following techniques to control their emotions when making choices:

1. Be greedy when others are fearful and fearful when others are greedy.

Traders widely use the index to adhere to Warren Buffett’s maxim that one should be “greedy when others are fearful and fearful when others are greedy.” To determine whether you succumb to the market’s emotions, keep an eye on the Crypto Fear and Greed Index.

2. Apply the dollar cost averaging investment technique.

Due to its ability to take emotion out of the investment process, dollar-cost averaging (DCA) is a preferred investment method in cryptocurrency. Instead of attempting to time the market with a single significant investment, the strategy calls for frequent small investments over time.

3. Increase your variety.

To reduce systemic and asset-specific risk, the investment bank Morgan Stanley analysts advise investors to “Develop a strategy that diversifies your investments across different asset classes and investment vehicles.” They believe doing this can help you control your emotional response during market volatility.

CNNMoney inspired the Crypto Fear and Greed Index

A Fear and Greed Index for stocks was first developed by the financial channel CNNMoney. It evaluated the degree to which various indicators deviated from their averages to assign the stock market a rating between 0 and 100. The concept was undoubtedly inspired by CNN, even though the Crypto Fear and Greed Index uses different indicators.

Final Thoughts

The Crypto fear and greed index is not a tool that should be used to make financial decisions on its own. Investors should conduct their due diligence to ensure that the decisions they make concerning potential investments in the crypto market are sound and sane. Bearing in mind that the crypto market is one of the most volatile markets in the world, the first step to managing risk in the field is by reducing exposure. Investors should generally not invest what they cannot afford to lose.