The collapse of FTX might have thrust crypto exchanges into the news for all the wrong reasons, but these platforms have become an integral part of the crypto ecosystem over the years. They offer an easier way to buy, sell, and store virtual assets. They’ve also become great data sources for on-chain analysts interested in gauging market sentiment and providing trading signals and insights.

The exchange balance is one aspect of crypto exchanges that lends itself well to technical analysis and on-chain metrics. When combined with other metrics, monitoring the flow of cryptocurrency into and out of exchanges can allow traders to identify if the market is in a bullish or bearish phase, which can help you make smarter investment decisions.

In this short guide, we’ll explain why this critical component of the money flow in crypto exchanges is essential to the broader market and how you can use data derived from it to evaluate investor behavior.

What is an Exchange Balance?

Exchange balance, or exchange reserve, refers to the number of coins held in multiple wallet addresses on a specific exchange. As the exchange balance values continue to rise, it indicates increased selling pressure and a general price trend in the opposite direction. And because coins can be used to open both long and short positions in a derivative exchange, an increase in the exchange balance indicates possible high volatility.

If an exchange holds a large amount of crypto, it usually means there’s a lot of liquidity for buying and selling tokens. A high level of liquidity indicates that the market for a specific cryptocurrency is active. As a result, trading cryptos in a liquid market is more accessible because trade orders are filled more effectively due to the present volume.

On the other hand, when there are fewer coins kept on an exchange, there is less market liquidity. Because price volatility is higher in a less liquid market, trading cryptocurrencies becomes riskier for traders. This is because there are fewer buyers to support prices in the event of an unexpected collapse and fewer sellers to prevent breakouts in the event of an abrupt recovery.

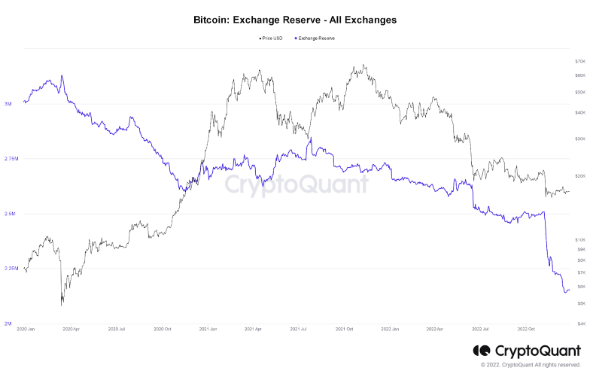

Using the chart below as an example, we can see that the balance of bitcoin (BTC) held on addresses linked to all crypto exchanges fell by almost 18% to 2.15 million coins in December 2022 from 2.62 million in November 2020.

This drop in the exchange balance of bitcoin indicates that across all exchanges, investors are hodling their bitcoin as they believe the cryptocurrency price will rise.

On the other hand, the following chart indicates the proportion of bitcoin held on addresses linked to the largest exchange by traded volume, Binance, has increased by about 52% to 598,832 in December 2022 from 312,205 in December 2020.

This means that Bitcoin is more liquid on Binance, and the likelihood is that investors are looking to sell the asset.

Exchange Inflows

An additional method of monitoring an exchange’s balance is to monitor the volume of crypto assets flowing in and out.

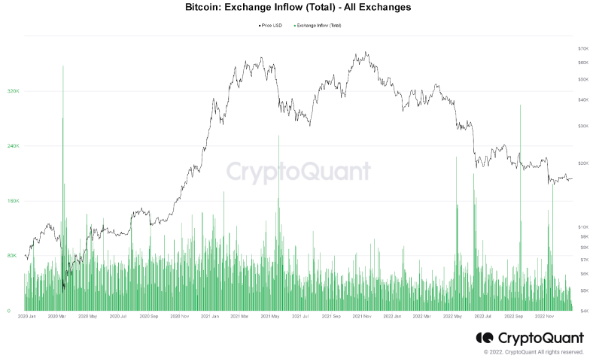

An exchange receives an influx of liquidity when cryptocurrencies are sent to addresses within it. Those sending the crypto usually also have to pay a transaction cost. Since no one appreciates having to spend money, this could be taken to mean that each investor’s decision must have some motivation.

In general, there are three main reasons why investors move their coins to an exchange:

- To sell: Investors are most likely sending their crypto for sale if there is an inflow to the spot exchange. This action is not only the result of custody services offered by institutional buyers, but it also includes the movement of retail buyers’ coins into exchanges. Moving crypto assets into exchange wallets rather than keeping them in cold storage usually suggests a desire to convert them to fiat or stablecoins. This kind of action typically results in a decline in the price of crypto, which is often considered a bearish sign.

- To trade in derivative markets: Sending crypto to wallets on the derivative market usually suggests that there will be an increase in derivative market trading. Since coins in the derivative market could be used to open both long and short positions, it is often difficult to predict how this behavior will affect the crypto price. However, it should generally be taken as a sign of greater market volatility.

- To use specific services offered by crypto exchanges: Investors occasionally transfer their coins to exchanges for staking and airdrops and meeting initial exchange offering (IEO) requirements. There’s usually little to conclude about pricing or volatility in this situation. Such actions are considered neutral in terms of their effect on the market.

Exchange Outflows

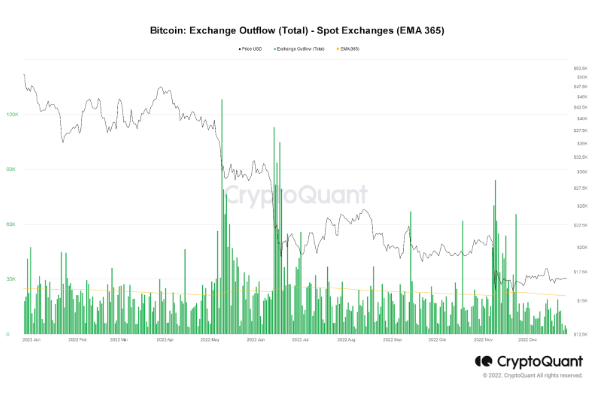

Exchange outflow is the movement of cryptocurrencies from exchanges into external wallets. In the same way, crypto flowing into exchanges creates an influx of liquidity; coins moving out of exchanges means liquidity is lost.

Outflows occur because of two main reasons:

- Moving coins after purchase: Whenever there’s an outflow from the spot exchange, it’s almost certain that investors are transferring funds to storage. Rather than leave their coins in exchange wallets, investors withdraw them for security and long-term holding. This action includes coins removed from the exchange by retail buyers and the result of institutional buyers’ custody services. The action usually results in a price increase, thus indicating a bullish sign for the market.

- Moving coins no longer required for derivative trade: Cryptocurrency movements may also be subject to derivative markets—the more liquidity removed from an exchange, the fewer trades can occur. Investors may withdraw crypto assets from derivative markets to take profits or reduce risk in their portfolios.

Identifying the Traders Who Are Moving Funds

Another important consideration in understanding exchange balances is the type of trader moving funds. Whales, or traders who own more than $1 million in a particular cryptocurrency, are essential to watch when analyzing exchange flows.

Even though small retail investors are increasingly active in crypto trading, institutional investors and whales continue to drive crypto trades and influence market trends.

For example, if whales sell off their crypto holdings as prices rise, a market top could be on the horizon – especially if smaller investors are actively buying up.

Following the activities of whales is an excellent way to monitor who is moving funds onto or away from crypto exchanges, as whales tend to buy crypto when markets are at their lowest and sell when markets are at their highest, setting the trend for the smaller retail investors.

Conclusion

We’ve seen that exchange balances are crucial in the on-chain analysis of crypto sentiment and investor behavior. They can provide a variety of metrics, such as high and low selling pressure, as well as market bullishness or bearishness. And while there are other more technical metrics to consider, a thorough understanding of the dynamics of exchange balances and what they portend for the crypto market is crucial to becoming a distinguished crypto trader.

Looking at the value of the exchange balance can reveal selling pressure. In contrast, the balance trend, which is determined by the inflow and outflow of an exchange, can show the changing status of a cryptocurrency’s scarcity.

A large exchange balance indicates that many coins are waiting to be traded on an exchange. As demonstrated in the guide, this situation signifies high selling pressure. On the other hand, a low-value balance indicates that there is very little crypto in an exchange, implying that there is little selling pressure.